The Product Benchmarks Every Financial Services Company Should Know

Outperform financial services competitors with exclusive data and strategies from our Product Benchmark Report.

From online banking to buy-now-pay-later, digital financial services have become an indispensable part of how we live and work. And the market continues to grow, with revenue forecast to reach $1.5 trillion by the end of the decade.

The best players in the business are poised to capture the biggest share of the burgeoning demand for these products. In this post, we share how you can join them, drawing on exclusive data and takeaways from our 2025 Product Benchmark Report. You’ll discover where finserv teams stand today, how top performers win, and what to do next.

About the Product Benchmark Report

Our benchmark analysis relies on Amplitude’s behavioral database and a robust statistical methodology. It draws on anonymized performance and engagement data from over 2,600 companies across industries, regions, and company sizes. We excluded data from customers who opted out of this analysis. Data spans the months between September 2023 to September 2024.

What the numbers say: Financial services product benchmarks

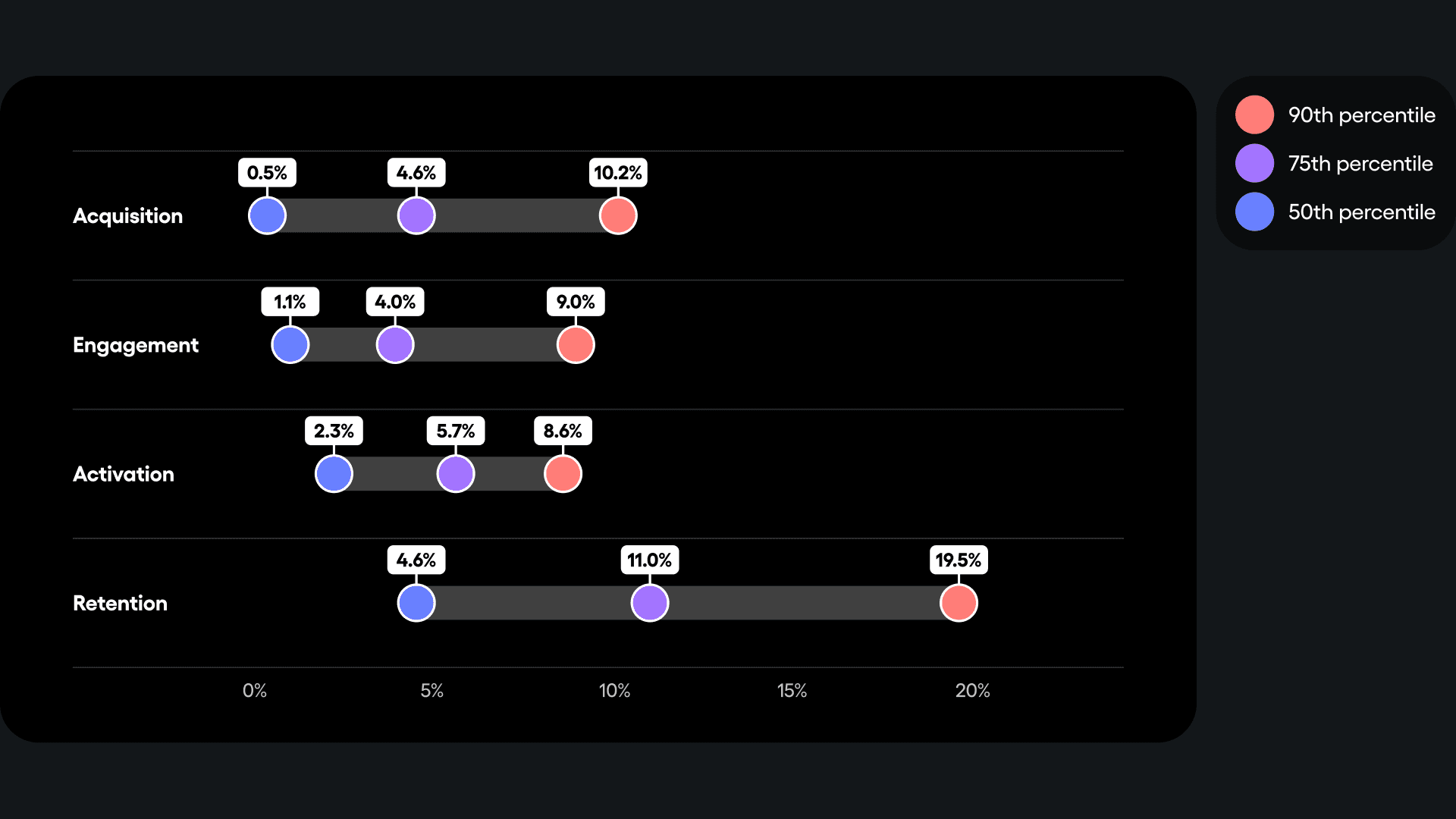

Acquisition, activation, engagement, and retention rates for the financial services industry’s 50th, 75th, and 90th percentiles.

Our analysis shows just how much it pays to be the best. While financial services products at the median level saw small, sustained gains with a monthly new user growth rate of 0.5%, top performers told another story, with a growth rate of 10.2%. That gap is a big deal when you consider that it means top products grew more than 20x faster than their median counterparts. And that speed adds up: Top financial services products saw an annual acquisition rate of a whopping 221%.

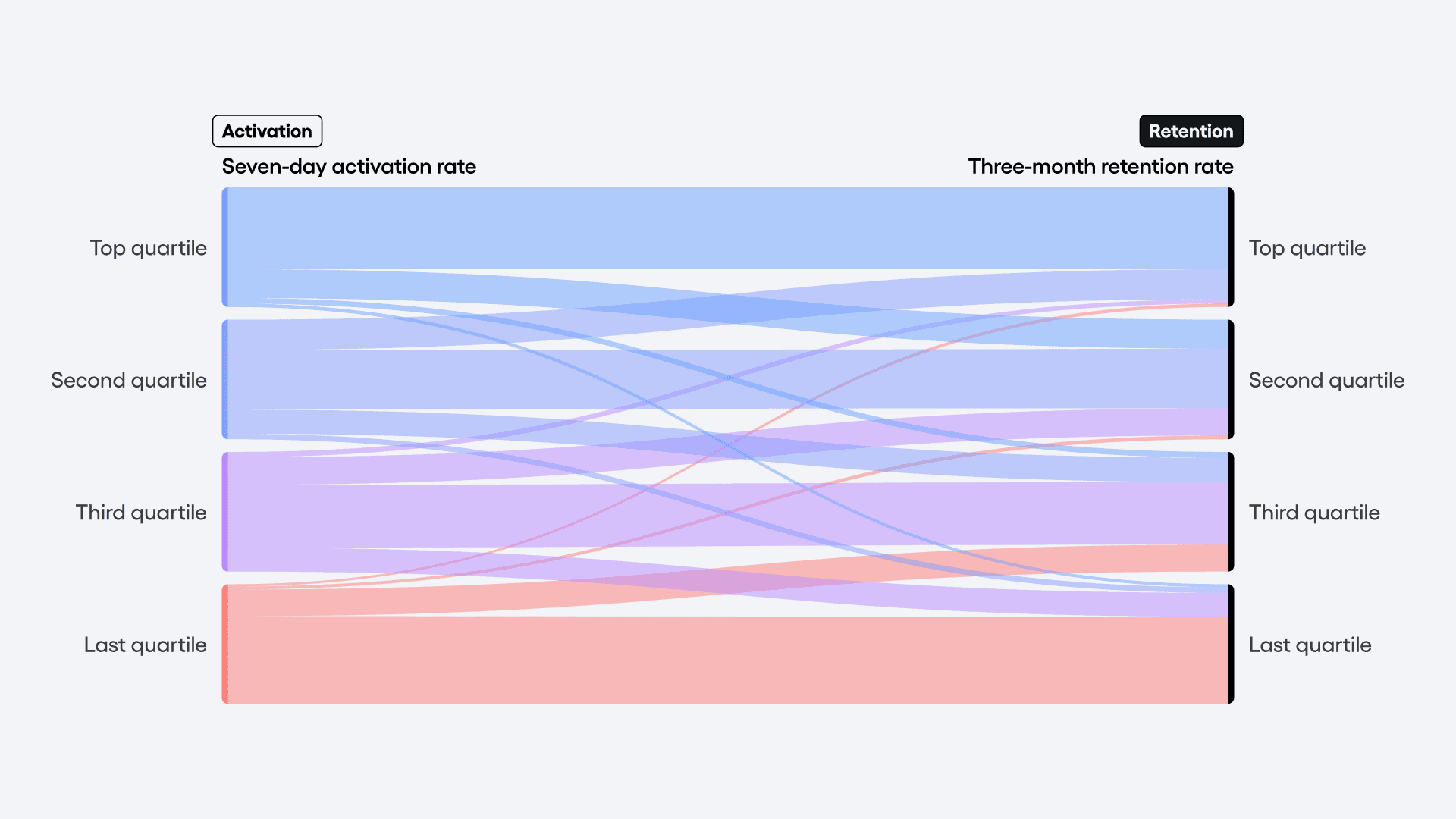

But adding new users will only take you so far. Our analysis of companies across all industries found that the leaky bucket problem is real. In fact, there was no relationship between products in the top quartile for adding users and those in the top quartile for retention. That means solely focusing on the top of the funnel won’t guarantee you repeat customers.

A better bet? Focus on delivering value, ideally within the first week. We found 69% of products with strong early activation were also strong three-month retention performers, demonstrating that speed matters. And that difference compounds. For example, at three months, the top financial services products retain 19.5% of their customers while the median financial services products retain 4.6%—a 4x difference.

Early activation leads to strong retention

The real challenge for most products, regardless of industry, isn’t attracting users; it’s keeping them around long-term. A seamless customer experience that quickly gets users to that first aha moment is key. Indeed, if your users come back after one week, there’s a good chance they’ll still be around months later.

This chart illustrates how activation (left) relates to retention (right). The thick blue bar at the top shows that users in the top quartile of activation are also in the top quartile of retention. The thick pink bar at the bottom shows that the opposite is true. This suggests a strong correlation between activation and retention.

Want to know how your product stacks up? Compare your data with our product benchmarking tool.

3 strategies to perform like the best financial services companies

So now you know how important early activation is to long-term retention. How do you go about boosting it? Borrow these winning strategies from top financial services companies.

1. Improve user trust with better onboarding

Users quickly churn if initial friction triggers doubt. Frictionless onboarding (especially on mobile), clear communication about your product’s value, and the ability to deliver on that promise all go a long way toward increasing activation and retention.

Do it in Amplitude: Use funnels and journeys to detect where users abandon account setup, so you can simplify verification flows and educate users on security benefits early.

2. Identify what’s working

Compare product engagement between user groups to see exactly how different campaigns, channels, and feature adoption impact your downstream metrics. Identify your top-performing campaigns and messages, then build lookalike audiences to target similar customers.

Do it in Amplitude: Use cohorts to identify your best user groups and the campaigns and channels that resonated with them. Then use Activation to send those audiences to downstream engagement platforms like Braze, Iterable, or HubSpot.

3. Drive user action and engagement

Encourage users to take key financial actions, such as opening an account or taking advantage of a balance transfer offer, with personalized experiences based on behavioral insights. Guiding users through financial milestones like these helps users realize the value of your product, increasing retention and revenue.

Do it in Amplitude: Use Guides and Surveys to act on trends and hypotheses with personalized customer experiences, such as in-app guides to nudge users along when they get stuck or messaging that highlights new offers.

How Nerdwallet uses Amplitude to jumpstart mobile click-through rates

When personal finance company Nerdwallet noticed that mobile users were 2x less likely to click through critical flows than web users, it turned to Amplitude to figure out why and how to fix the problem. After discovering the culprit was load times, Nerdwallet re-architected its apps and redesigned its mobile user experience. The result? Load times decreased by 58% and mobile click-through rates increased by 200%.

Put your product on the path to growth with benchmark insights

The outlook for financial services businesses continues to be promising. Smart strategies, such as focusing on activation, can help them make the most of that advantage.

Product Benchmark Report

Discover what else our Product Benchmark Report reveals about the way the best-performing companies win and the lessons you can apply at your own organization.

Noorisingh Saini

Global Content Marketing Manager, Amplitude

Noorisingh Saini is a data-driven marketer managing global content marketing at Amplitude. Previously, she managed all customer identity content at Okta. Noorisingh graduated from Yale University with a degree in Cognitive Science.

More from NoorisinghRecommended Reading

Our Quest to Become AI-First and What We Learned

Jan 28, 2026

5 min read

Stop Reacting to Customer Churn—Start Predicting It

Jan 27, 2026

12 min read

Amplitude Pathfinder: Jamie Dunbar Smyth’s Obsession with Growth

Jan 26, 2026

10 min read

Why Finserv Contact Centers Need Digital Analytics, Not More Dashboards

Jan 23, 2026

6 min read